如何在 Excel 中計算平均年增長率/複合年增長率?

本文將介紹在 Excel 中計算平均年增長率 (AAGR) 和複合年增長率 (CAGR) 的方法。

在 Excel 中計算複合年增長率

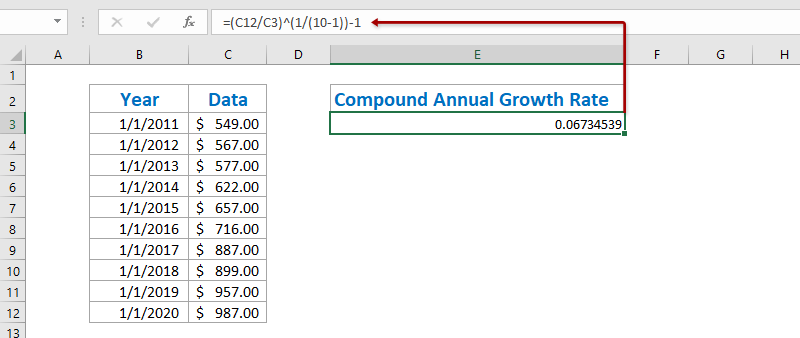

要在 Excel 中計算複合年增長率,有一個基本公式 =((結束值/起始值)^(1/期數) -1。我們可以輕鬆應用此公式如下:

1. 選擇一個空白單元格,例如單元格 E3,將以下公式輸入其中,然後按下 Enter 鍵。請參閱截圖:

=(C12/C3)^(1/(10-1))-1

注意:在上述公式中,C12 是包含結束值的單元格,C3 是包含起始值的單元格,10-1 是起始值和結束值之間的期數,您可以根據需要進行更改。

2在某些情況下,計算結果可能不會以百分比格式顯示。請繼續選擇計算結果,點擊 百分比樣式 按鈕 ![]() 位於 Home 標籤上,將數字轉換為百分比格式,然後通過點擊 增加小數位數 按鈕

位於 Home 標籤上,將數字轉換為百分比格式,然後通過點擊 增加小數位數 按鈕 ![]() 或 減少小數位數 按鈕

或 減少小數位數 按鈕 ![]() 。請參閱截圖:

。請參閱截圖:

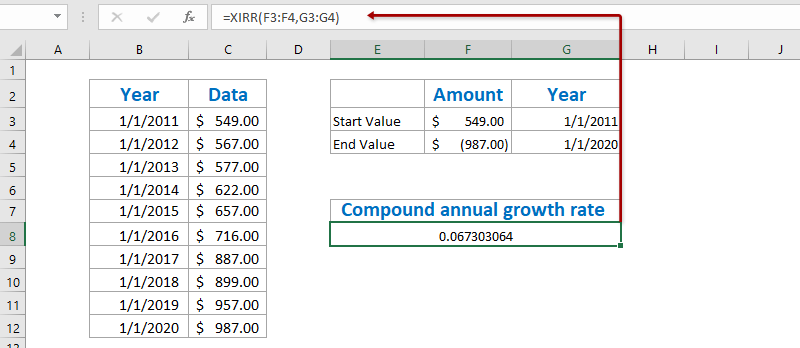

在 Excel 中使用 XIRR 函數計算複合年增長率

實際上,XIRR 函數可以幫助我們輕鬆地在 Excel 中計算複合年增長率,但這需要您創建一個包含起始值和結束值的新表格。

1. 創建一個包含起始值和結束值的新表格,如下所示的第一張截圖:

注意:在單元格 F3 輸入 =C3,在單元格 G3 輸入 =B3,在單元格 F4 輸入 =-C12,在單元格 G4 輸入 =B12,或者您可以直接將原始數據輸入到這個表格中。順便提一下,您必須在結束值前添加負號。

2. 在此表格下方選擇一個空白單元格,將以下公式輸入其中,然後按下 Enter 鍵。

=XIRR(F3:F4,G3:G4)

3要將結果轉換為百分比格式,選擇包含此 XIRR 函數的單元格,點擊 百分比樣式 按鈕 ![]() 位於 Home 標籤上,然後通過點擊 增加小數位數 按鈕

位於 Home 標籤上,然後通過點擊 增加小數位數 按鈕 ![]() 或 減少小數位數 按鈕

或 減少小數位數 按鈕 ![]() 。請參閱截圖:

。請參閱截圖:

快速將 CAGR 表格保存為迷你模板,並在未來只需點擊一次即可重用

每次引用單元格並應用公式來計算平均值一定非常繁瑣。Kutools for Excel 提供了一個 AutoText 工具的巧妙解決方案,可將範圍保存為 AutoText 條目,該條目可以保留範圍內的單元格格式和公式。然後,您只需點擊一下即可重用此範圍。

在 Excel 中計算平均年增長率

要在 Excel 中計算平均年增長率,通常我們必須使用公式 = (結束值 - 起始值) / 起始值來計算每年的年增長率,然後對這些年增長率求平均值。您可以按照以下步驟操作:

1. 在原始表格之外,將以下公式輸入到空白單元格 C3 中,然後拖動填充柄至範圍 C3:C11。

=(C4-C3)/C3

2選擇範圍 D4:D12,點擊 百分比樣式 按鈕 ![]() 位於 Home 標籤上,然後通過點擊 增加小數位數 按鈕

位於 Home 標籤上,然後通過點擊 增加小數位數 按鈕 ![]() 或 減少小數位數 按鈕

或 減少小數位數 按鈕 ![]() 。請參閱截圖:

。請參閱截圖:

3. 將所有年增長率平均,將以下公式輸入到單元格 F4 中,然後按下 Enter 鍵。

=AVERAGE(D4:D12)

到目前為止,平均年增長率已經被計算出來並顯示在單元格 C12 中。

演示:在 Excel 中計算平均/複合年增長率

相關文章:

最佳 Office 生產力工具

| 🤖 | Kutools AI 助手:以智能執行為基礎,革新數據分析 |生成程式碼 | 創建自訂公式 | 分析數據並生成圖表 | 調用 Kutools 增強函數… |

| 熱門功能:查找、選取項目的背景色或標記重複值 | 刪除空行 | 合併列或單元格且不遺失數據 | 四捨五入(免公式)... | |

| 高級 LOOKUP:多條件 VLookup|多值 VLookup|多表查找|模糊查找... | |

| 高級下拉列表:快速創建下拉列表 |依賴型下拉列表 | 多選下拉列表... | |

| 列管理器:添加指定數量的列 | 移動列 | 切換隱藏列的顯示狀態 | 比較區域及列... | |

| 精選功能:網格聚焦 | 設計檢視 | 增強編輯欄 | 工作簿及工作表管理器 | 資源庫(快捷文本) | 日期提取器 | 合併資料 | 加密/解密儲存格 | 按列表發送電子郵件 | 超級篩選 | 特殊篩選(篩選粗體/傾斜/刪除線...)... | |

| 15 大工具集:12 項文本工具(添加文本、刪除特定字符…)|50+ 儀表 類型(甘特圖等)|40+ 實用 公式(基於生日計算年齡等)|19 項插入工具(插入QR码、根據路徑插入圖片等)|12 項轉換工具(金額轉大寫、匯率轉換等)|7 項合併與分割工具(高級合併行、分割儲存格等)|...及更多 |

運用 Kutools for Excel,全面提升您的 Excel 技能,體驗前所未有的高效。 Kutools for Excel 提供超過300 項進階功能,讓您提升工作效率、節省時間。 點此尋找您最需要的功能...

Office Tab 為 Office 帶來分頁介面,讓您的工作更加輕鬆簡單

- 在 Word、Excel、PowerPoint 中啟用分頁編輯與閱讀。

- 在同一視窗的新分頁中打開與創建多份文件,而非開啟新視窗。

- 提升您的生產力50%,每日可幫您減少數百次鼠標點擊!

所有 Kutools 外掛,一次安裝

Kutools for Office 套裝整合了 Excel、Word、Outlook 和 PowerPoint 的外掛,外加 Office Tab Pro,非常適合需要跨 Office 應用程式協同作業的團隊。

- 全合一套裝 — Excel、Word、Outlook及 PowerPoint 外掛 + Office Tab Pro

- 一鍵安裝,一份授權 — 幾分鐘完成設置(支援 MSI)

- 協同運作更順暢 — Office 應用間無縫提升生產力

- 30 天全功能試用 — 無需註冊、無需信用卡

- 最超值 — 一次購買,節省單獨外掛費用